Structural integrity experts play a vital role in insurance, offering specialized knowledge to assess vehicle damage accurately. Their detailed evaluations, using advanced tools, help insurers make unbiased claims decisions, mitigate fraud, and ensure fair repairs, particularly for luxury autos, thereby streamlining the entire process.

Insurers rely on structural integrity experts for accurate risk assessments, ensuring policy decisions are informed and reliable. This article delves into the critical role these specialists play in the insurance industry. Understanding structural integrity expertise involves recognizing the meticulous analysis and advanced knowledge applied to evaluate building conditions. By leveraging their skills, insurers gain confidence in coverage determinations, fostering trust and peace of mind for policyholders. Discover why structural integrity professionals are indispensable assets in navigating complex risk assessment challenges.

- Understanding Structural Integrity Expertise in Insurance

- The Role of Experts in Ensuring Accurate Risk Assessment

- Why Insurers Rely on Structural Integrity Professionals

Understanding Structural Integrity Expertise in Insurance

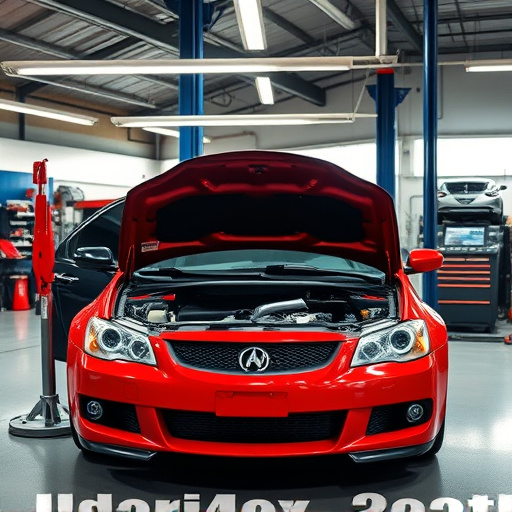

Structural integrity expertise plays a pivotal role in the insurance industry, ensuring accurate assessments and claims processing. These specialists are highly skilled professionals who possess in-depth knowledge of various structures, from buildings to vehicles. Their primary focus is to evaluate the structural soundness and damage of assets, which is crucial for insurers to make fair and informed decisions.

Insurers trust structural integrity experts because they bring a unique set of skills, including meticulous attention to detail, comprehensive industry knowledge, and practical experience. When it comes to assessing vehicle repair claims, these experts can differentiate between minor cosmetic issues and significant structural damage, which is vital for accurately determining compensation. Their expertise extends to luxury vehicle repair as well, where precision and an understanding of high-end automotive components are essential. Ultimately, their contributions streamline the claims process, reduce fraud, and foster trust between insurers and policyholders.

The Role of Experts in Ensuring Accurate Risk Assessment

Insurers rely on structural integrity experts to ensure accurate risk assessment and mitigate potential losses. These professionals bring a wealth of knowledge and specialized skills to assess the structural soundness of vehicles, which is crucial in the event of an accident or claim. By meticulously examining every component, from frames and panels to safety systems, they provide insurers with reliable data that aids in making informed decisions.

Structural integrity experts play a vital role in the insurance industry by offering unbiased and precise evaluations. Their expertise goes beyond mere visual inspections; it involves advanced diagnostic tools and techniques to uncover potential weaknesses or damage not immediately apparent. This thorough approach is especially valuable when dealing with complex cases, such as severe fender benders or car body restoration projects, ensuring that insurers offer appropriate coverage and compensation while maintaining the integrity of their financial health.

Why Insurers Rely on Structural Integrity Professionals

Insurers rely on structural integrity professionals for their expertise and specialized knowledge when it comes to assessing and determining the accuracy of a vehicle’s condition, particularly in cases involving car restoration or automotive body work. These experts are highly trained and skilled in evaluating the structural integrity of vehicles, ensuring that every component is in its proper place and functioning correctly. This is especially critical in the event of accidents, where structural damage can be subtle but significant.

Structural integrity experts possess advanced tools and techniques to detect even the slightest deviations from a vehicle’s original structure. Their role is crucial when it comes to accurately determining the extent of repairs needed, whether for car scratch repair or more complex automotive body work. By relying on these professionals, insurers can make informed decisions, ensuring that claims are settled fairly and quickly while minimizing potential fraud or over-compensation.

Insurers increasingly rely on structural integrity professionals for accurate risk assessment and precise insurance coverage. These experts bring a wealth of specialized knowledge and hands-on experience, ensuring that buildings and structures are assessed comprehensively. By leveraging their expertise, insurers can make informed decisions, mitigate risks effectively, and provide tailored coverage, ultimately enhancing customer satisfaction and financial security. Structural integrity experts play a pivotal role in the insurance industry, fostering trust and reliability through meticulous analysis and unbiased assessments.